An introduction to Venture Capital

- Jamie Clark

- Sep 18, 2025

- 5 min read

Updated: Nov 1, 2025

As more investment into entrepreneurship flows through Venture Capital funds, in this article I share an introductory guide.

Venture Capital (VC) is money invested into startups with high growth potential.

And, unlike a bank loan, it’s not about repayment with an interest rate attached.

Instead, VCs buy equity (ownership) into the company, hoping that one day the company will reach a high value and return well to the investors in the fund, either via an acquisition or via a public offering (listing on the public stock exchange).

When selling a part of your company, there are some things to consider: loss of ownership, controls, pressures etc. So, in this sense, not all money is created equal. VCs, particularly the good ones, are known to provide more than just funding. They also may offer advice, industry connections, and strategic guidance to help you grow. This is what makes VC unique.

And how are VC funds formed? I think it's important that we break it down:

How Venture Capital funds are created

When someone (or various people) decide to start a fund, these people first come together to develop an investment thesis - a guiding idea based on their expertise and knowledge of a particular market. And this thesis outlines the types of investments they believe will be most promising.

They present their thesis to high-net-worth individuals - often operators within the startup ecosystem - as well as to larger institutions and family offices, explaining why they believe their investment strategy will succeed.

Once the predetermined fund target has been committed, the fund is closed and typically operates on a 10-year timeline: the first five years are usually dedicated to making investments, while the remaining five focus on supporting portfolio companies and doubling down on the most promising opportunities.

Fund lifecycle is 10 years, with 5 years allocated to investing, and 5 years for follow-on oppotunities

Over this period, the fund’s goal is for its portfolio companies to grow significantly in value, either through scaling their operations, achieving strong market positions, or developing innovative products that attract attention in the industry.

For the investor, ideally these companies will eventually reach liquidity events - such as acquisitions, mergers, or public offerings - that allow the fund to generate returns. VC Funds may encourage/pressure the founders of the startup to create these outcomes.

Once this happens, those returns are then distributed back to the fund’s investors, with both the general partners and limited partners benefiting from the value that has been created over the life of the fund.

Let's use an example.

Fund name: 123 Ventures

Fund size: $50M

Pre-seed investment made: $1M in "StartupX"Step 1 – Pre-seed round

StartupX raises a total of $2M pre-seed round at a $8M post-money valuation. (the decided value of the company at that time, read this article for more on valuations)

The VC invests $1M and owns of the company 12.5%

Step 2 – Dilution through later rounds*

*Dilution occurs when a company issues new shares, reducing the ownership percentage of existing shareholders.

StartupX raises additional investment rounds before IPO (public market):

Seed round: $10M at $40M post → VC diluted from 12.5% → ~10%

Series A-B: $40M at $200M post → VC diluted to ~8%

Series C-D: $100M at $500M post → VC diluted to ~6%

Initial Public Offering: company goes public at $5B valuation

Step 3 – Value at IPO

VC owns 6% of StartupX at IPO.

Value of VC’s stake:

5B × 6%= $300M

Step 4 – Multiple on invested capital

Original investment: $1M

Value at IPO: $300M

Return multiple: 300x return

Step 5 – Impact on fund

Fund size: $50M

This single investment returned $300M → 6x the entire fund from one deal.

Sounds pretty good right?

For many VC funds, a single investment can sometimes represent a significant portion of the entire fund. However, they know that the vast majority of their portfolio companies will not succeed and may eventually fail. If they manage to invest in a future 'unicorn' - a company valued at over $1 billion - it can become an extremely attractive asset for investors, but one that carries significant risk.

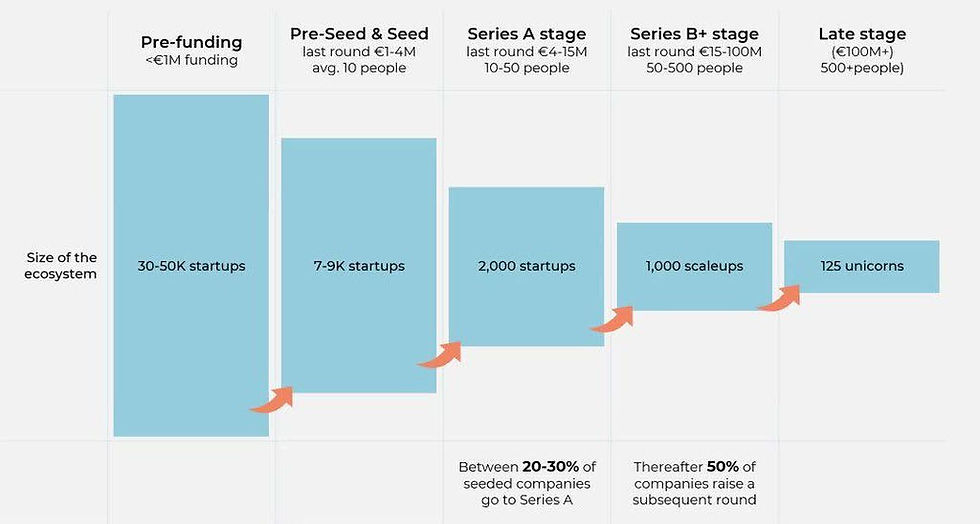

As shown in the graph below, very few startups that have received between $1 million and $4 million in funding ultimately reach the late stage.

The Funding Cycle

Venture capital firms typically specialize in specific stages of a startup’s lifecycle, from early seed funding to later-stage growth rounds.

Each stage comes with its own nuances, and investors focus on different criteria depending on where a company sits in its journey.

Importantly, the thesis that general partners signed off by their limited partners often dictate the stage in which they can invest. These agreements set expectations around risk, return, and investment horizon, meaning a VC fund usually cannot freely shift between early and late-stage investing - they operate within the boundaries defined by their fund’s mandate.

Simplified benchmarks.

Stage | Typical Funding | Goal / Use | Key Metrics / Milestones | Typical Employees | Revenue Range |

Pre-seed / Seed | $100K – $2M | Validate idea, build MVP, acquire first customers | Prototype ready, initial users, market research completed | 2–10 | Minimal / initial revenue |

Series A | $2M – $15M | Scale product, hire core team, expand market presence | 1,000–10,000 users/customers, strong product-market fit, early revenue ($100K–$1M ARR) | 10–50 | $100K – $2M ARR |

Series B | $10M – $50M | Expand operations, grow revenue, optimize processes | 10,000–100,000 users/customers, consistent revenue growth ($1M–$10M ARR), operational metrics like CAC, LTV, churn | 50–150 | $2M – $20M ARR |

Series C / D / Later | $30M – $100M+ | Rapid expansion, international growth, product diversification | Large-scale revenue ($10M–$100M+), market leadership, high retention, efficient unit economics | 150–500+ | $20M – $100M+ ARR |

Exit | N/A | Acquisition or IPO | Return on investment for investors, large liquidity event | Varies | Varies |

Examples of Venture Capital firms in Spain

Below is a list of leading VC funds in Spain by stage, with their websites linked so you can explore their investment theses and portfolio companies.

Seed / Early

Series A

Growth+

Now, for the good, bad and ugly of receiving Venture Capital investment.

THE GOOD

Access to capital that can accelerate growth far beyond bootstrapping. In many industries, speed is everything.

Strategic guidance, mentorship, and industry connections that help scale the business.

Credibility and validation, creating signals of market confidence and attracting talent, partners, and customers.

Networking opportunities with potential clients, hires, and co-investors.

Ability to focus on long-term growth and market capture rather than immediate profitability.

THE BAD

Equity dilution, meaning founders give up a portion of ownership and may lose control over key decisions.

High pressure to perform, with investors expecting rapid growth and returns.

Loss of autonomy as VCs may influence strategy, product decisions, or hiring.

Intense scrutiny on financials, metrics, and operations, leaving little room for experimentation.

Time-consuming fundraising process, including pitching, due diligence, and negotiations, which can distract from running the business.

THE UGLY

Misaligned goals, where investor priorities (like fast exits) conflict with the founder’s vision.

Risk of failure despite funding, sometimes accelerated by pressure to grow quickly.

Potential for toxic relationships due to miscommunication or differing expectations with investors.

Loss of company culture and vision, with rapid scaling leading to employee dissatisfaction or mission drift.

Caught up in the glamour of raising big rounds and not focused on performing at a high level. The money feels like free money.

That’s your introduction to venture capital. There's a lot more to it, a lot of nuance, but for starting out, I hope you found this article useful.

One key reflectionn is that VC funding isn’t the only option for early-stage businesses. There are other ways to raise capital, including grants, crowdfunding, venture debt, and more.

In this article, I explore each option in detail, highlighting the pros and cons to help you make informed funding decisions.

Happy fundraising.